Concentrated liquidity

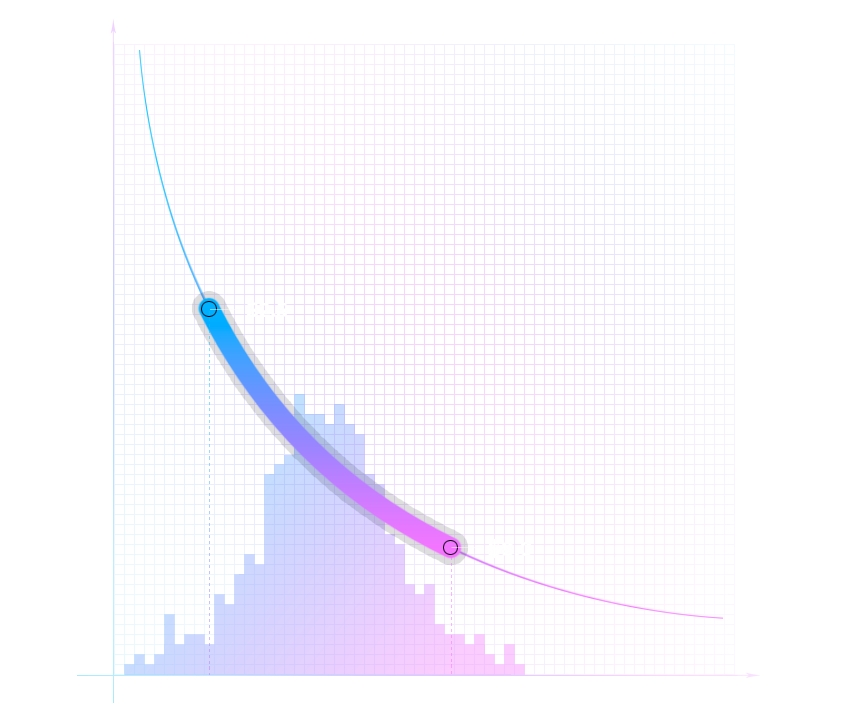

Most Automated Market Makers (AMMs) have their liquidity distributed evenly along an x*y=k price curve, with assets reserved for all prices between 0 and infinity.

This means that there is as much liquidity at the extreme price ranges as there is at average price ranges. This means the liquidity is aggregated inefficiently where most of the assets held in a pool are never touched.

LPs only earn fees on a small portion of their capital, which can fail to appropriately compensate for the price risk (“impermanent loss”) they take by holding large inventories in both tokens.

Additionally, traders are often subject to high degrees of slippage as liquidity is spread thinly across all price ranges.

With Convexus, LPs can concentrate their capital within custom price ranges, providing greater amounts of liquidity at desired prices. In doing so, LPs construct individualized price curves that reflect their own preferences.

Trading fees collected at a given price range are split pro-rata to LPs, proportional to the amount of liquidity they contributed to that range.

Last updated